Without proper planning, efforts are lost, and this is especially true for sales organizations.

If you don’t have a well-thought-out sales budget, it can be easy to lose momentum and lose sight of your sales targets.

In this article, we’ll go over what sales budgets are, the components of a budget, and how to create one, and give a couple of real-world examples of sales budgets you can model yours off of.

What is a sales budget?

Sales budgets are financial documents that estimate an organization’s total revenue over a specific time period. They allow business owners to roughly predict sales volumes, unit prices, and total income over a time period, usually monthly, quarterly, or annually.

Effective sales budgets consider several factors so that sales leadership can accurately anticipate the revenue generated from closed deals.

Why Sales Budgets are Important

Sales budgets are vital assets for any business that wants to hit its sales targets and grow consistently over time. In other words, just about every business on the planet can benefit from writing a sales budget.

The primary purpose of a sales budget is to act as a financial plan for the business to meet its goals. Sales revenue projections allow the company to anticipate its cash flow and sufficiently allocate resources to sales funnel activities and operational costs.

Writing a sales budget also allows businesses to prepare for any hurdles that may arise, which can impact sales performance. This process starts with analyzing historical sales data and ends with considering current market conditions. Sales leaders must also consider striking up conversations internally (with sales staff) and externally (with customers) to get valuable insights for setting their budget.

Sales Budget vs Sales Forecast: What’s the difference?

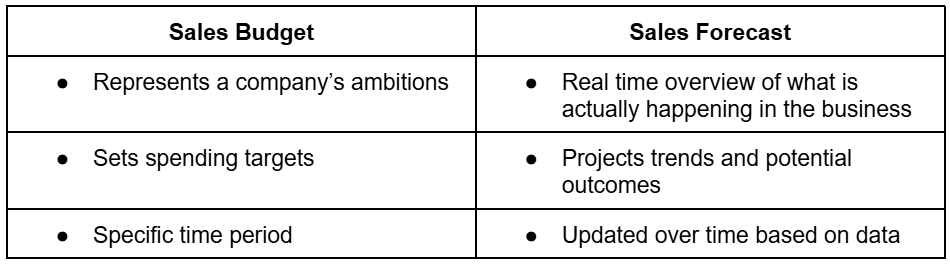

Sales budgets and forecasts might seem similar to the layman, but this is not the case.

Sales budgeting is the process of creating a financial plan that estimates how much revenue a business can generate within a specific time period. Sales forecasting is the process of creating an estimate of future sales revenues. Budgets can be used to inform forecasts; they can be used hand-in-hand.

For example, if your sales budget accounts for a plan to sell 500 units at $25 over the course of 6 months, you might use this data to forecast whether the company can hit its long-term goals based on real-time sales data. If the budget does not align with reality, the strategy must be adjusted to meet the sales forecast.

How to Create a Sales Budget in 5 Steps

Once you have the basic components down, it’s time to set time parameters, take stock of inventory, and consider any and all factors that might impact sales revenue.

Set a Time Period for the Budget

The first task in sales budgeting is to select a time period for which you’re creating a budget. This is typically done monthly, quarterly, or annually.

Keep in mind that the longer period you choose, the more nuanced information is lost in your planning process. Monthly budgets are often more exact and easier to manage than long-term budgeting. Annual budgets are more difficult to set, especially in industries where market conditions, both internal and external, change rapidly.

However, if you have enough data and insight into your business, annual budgets are a powerful tool you can leverage to meet and surpass sales quotas. From here, you can work backward, breaking down the annual budget into fiscal quarters and then into monthly budgets.

It’s important to consider your sales cycle length and when products or services are sold. The time period you choose for your budget must make sense for your specific business. For example, quarterly sales budgets make the most sense if you run a seasonal business. If your sales cycle is short and sold year-round, then monthly sales budgets are better suited for you.

Do Your Inventory and Write a Price List

To accurately predict future sales, it’s important to assess your pricing and product availability. Will your prices stay the same, increase, or decrease? Are you introducing new products or discontinuing existing ones? Answering these questions will help you make more accurate sales projections.

Analyze Past Sales Data

After you take stock of your inventory and have an accurate price list, it’s time to dig into historical sales data. It’s important to make sure the data you’re looking at coincides with the time period you’ve set for your sales budget.

For example, if you were setting a sales budget for Q3 of the fiscal year, it would help to look at Q3 sales figures from the previous year for an accurate comparison. From here, you’ll want to adjust metrics for growth and project future results.

Consider All Factors that Impact Sales

When setting a sales budget, it’s critical to consider external factors in addition to your internal historical sales data.

Your goals and trajectory should align with current market conditions, competitors, and the economic landscape. Public data about competing companies can give you new insights into where your sales goals align. Based on this valuable information, you might find your targets need adjustments, so keep an open mind.

You should also factor in market trends and current events if relevant to your specific market. For example, if you run a seasonal business like a roofing company, you might want to consider any changes in insurance policies in your region. You should also consider the consumer’s purchasing power for bigger projects, like roof replacements.

Finally, sales budgets should take into account 1:1 feedback from sales representatives and your customer base. Both contain powerful feedback that you can use to inform your sales budget.

Sales representatives have the closest relationship with customers, so they have a lot to say about buyer expectations, objections they’ve handled, and unaddressed wants. If you run an electronics store, you might learn from talking to sales representatives that consumers have a high demand for a particular product.

Talking to your customers directly gives you feedback of immeasurable value. Learning what customers think and feel through surveys or interviews is a great way to build rapport and increase trust with your company, all while gaining insights you can use in sales budgeting.

Calculate Your Sales Budget

When you’ve thoroughly analyzed all internal and external factors that might influence sales, it’s time to calculate your budget. This is as simple as estimating the total volume of sales and unit prices over a specific time period.

When creating an accurate budget, you need correct information across the board. This includes your inventory, price list, and factors that impact sales. When doing this step, you should record your methodology and reasoning as much as possible to review the plan vs. reality after the time period has concluded.

To make things easier, we recommend downloading a sales budget template to serve as a starting point for your document creation.

Practical Sales Budget Examples

Keeping the process we outlined in mind, let’s review some examples of sales budgets for a B2B business. The more products or services your company offers, the more complex sales budgeting will be.

Monthly Sales Budget Example

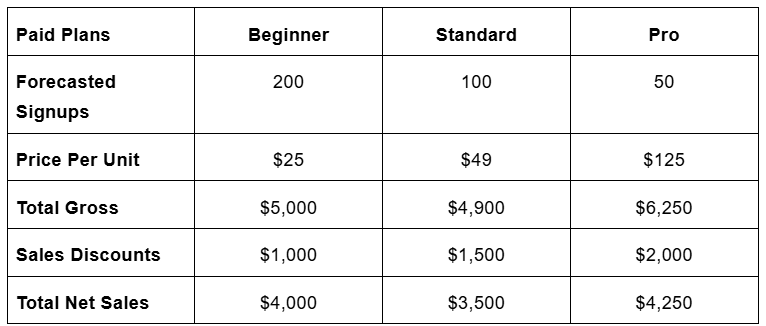

Monthly sales budgets are the most granular form, offering the most accurate and nuanced information. This is because short-term planning is easier to account for since long-term and overarching factors like market conditions don’t immediately impact monthly sales budgets.

For our 2 sales budget examples, we’ll use a fictional B2B software company that serves enterprise customers. Here’s an example of how this company might outline their sales budget for each tier of signups:

Annual Sales Budget Example

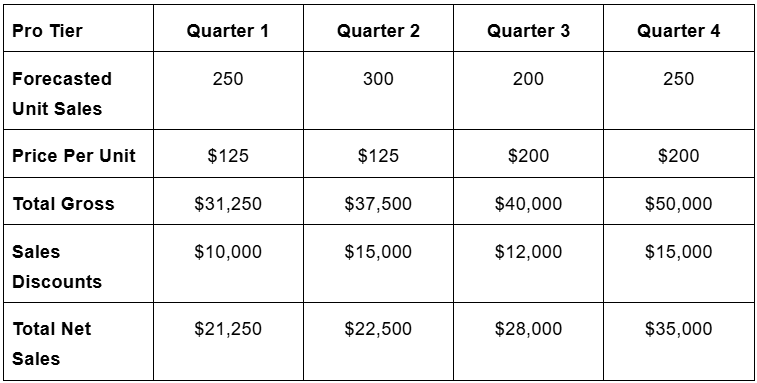

Annual sales budgeting gets more complex because each product’s sales must be evaluated over time. This is where multi-sheet spreadsheets really shine: you can have a separate budget tracker for each product or service.

Let’s review an annual budget for the same software company, highlighting its Pro tier over the course of a fiscal year. In this example, sales leadership decided to increase the Pro tier’s pricing from $125 to $200 in Q3.

Key Takeaways

Sales budgets are valuable tools that businesses can use to estimate their total net revenue over a specific time period. For example, a company may want to set a monthly or quarterly sales budget to hold its sales representatives accountable for targets while predicting cash flow.

While there might be a complexity of factors to consider when budgeting, creating your budget is as simple as following these 5 steps:

- Choose a relevant time period for your budget.

- Take stock of inventory and write a price list.

- Consider historical sales data.

- Analyze internal and external factors that impact sales.

- Sales budget calculation.

Once you have your budget on paper, it’s time to consider the sales and marketing tools you’ll need for sales success. At the very least, you should consider what sales CRM best suits your business. That’s where Instantly comes in—our AI-powered CRM gives you everything you need to manage your pipeline.

Sign up for a free trial today!