Picture this: Two customers make the same first purchase. Six months later, one has bought five more times while the other hasn't returned. Wouldn't you want to know why—and how to find more customers like the first one? That’s what the Customer Lifetime Value (CLTV) does.

This straightforward sales metric reveals which customers drive your profits and why. It goes beyond single transactions to show you the bigger picture of customer relationships.

More than just a number, CLTV helps you make smarter choices about where to spend your marketing budget and how to position your brand to keep your best customers coming back.

Here’s everything you need to know about calculating your CLTV, including why it matters and how to optimize this key metric for scalable growth.

What is Customer Lifetime Value (CLTV)

Customer retention is arguably the best driver of sustainable revenue. Yet, many businesses today focus solely on customer acquisition through channels like paid ads, SEO content marketing, cold emails, etc.

According to FirstPageSage, the average customer acquisition cost (CAC) for B2B SaaS is $546. That begs the question: are you recouping these noteworthy costs before customers churn? That’s what the CLTV helps you find out.

More specifically, your CLTV lets your business set realistic expectations about how much revenue you can generate from a single customer before they churn. The longer a customer buys your products/services, the higher the CLTV. So, let’s see how to calculate this value.

How to Calculate CLTV: A Step-by-Step Guide

Thankfully, calculating your business’s CLTV isn’t as tricky as it sounds. Before getting into the math, you first need to learn the formula for the following variables:

- Average purchase value (APV)

- Average purchase frequency (APF)

- Customer Value (CV)

- Average customer lifespan (ACL)

Average Purchase Value (APV)

To calculate the average purchase value (APV), simply divide your business’s total revenue by the number of transactions. Mathematically:

Average Purchase Value = Total RevenueNumber of Transaction

If, for instance, your total revenue for a given period is $50,000 and you get 1,000 orders over that same period, your APV will be calculated as $50,000/1,000, which equals $50.

Average Purchase Frequency (APF)

Your APF shows the frequency with which an average customer buys your products/services. We calculate this value by dividing the total number of purchases by the number of customers. Mathematically:

Average Purchase Frequency= Total Number of PurchasesNumber of Customers

If, for instance, your total number of purchases/transactions is 1,000 and 250 customers bought your product within a set period, your APF is calculated as 1,000/250 which equals 4.

Customer Value (CV)

Put simply, the customer value (CV) is the product of your APV and APF.

CV =Average Purchase Value X Average Purchase Frequency

Going by our previous example, your CV can be calculated as $50 x 4, which equals $200.

Average Customer Lifespan (ACL)

We get the average customer lifespan (ACL) by adding up your customers’ lifespan (how long they kept in business) and dividing it by the number of customers:

Average Purchase Frequency= Sum of Customers' lifespanNumber of Customers

Customer Lifetime Value (CLTV)

With all the variables ready, calculating for CLTV becomes as simple as getting the product of your APV, APF, and ACL. The equation becomes CLTV = CV x ACL.

CLTV =Customer Value X Average Customer Lifespan

CV is also equal to APV x APF. So, another way of looking at the equation would be CLTV = (APV X APF) x ACL.

Example of Calculating for CLTV

To put CLTV into perspective, let’s create a simple example for an ecommerce company. For this example, we’ll look into five of its customers, how much they spend, and how often.

- Customer 1: $20, Buys twice per month.

- Customer 2: $15, Buys three times per month.

- Customer 3: $50, Buys once a month.

- Customer 4: $10, Buys five times a month.

- Customer 5: $5, Buys four times a month.

Here’s how the calculations unfold:

- Average Purchase Value (revenue/transactions): CPV = (100/5). CPV = $20 per visit.

- Average Frequency Rate (# of purchases / # of customers): APF = (15/5). APF = 3/mo.

- Average Customer Value (APV X APF): To calculate average customer value, we must multiply each expenditure by the frequency of visits and get the average. ACV = $41. For this example, let’s say the average customer lifespan (ACL) is five years.

Customer Lifetime Value (ACV X ACL): CLTV = ($41 X 60 months). CLTV = $2,460.

Why is the CLTV Such an Important Metric to Monitor?

The CLTV is an essential metric for creating sustainable and scalable customer acquisition or lead generation campaigns. Here are a few reasons why:

It Shows the Effectiveness of Customer Acquisition Campaigns

Your Customer acquisition costs (CAC) should be lower than your CLTV. Aim for a 3:1 or 4:1 CLTV: CAC ratio. Keep in mind that the ratio varies significantly depending on the industry.

For example, ecommerce has an average COC of $168. That means you’d want your CLTV to be around $504 to $672.

CLTV Helps You Understand Customer Behavior and Demographic

Not every customer generates the same revenue for your business. Those who get your products/services after seeing a Facebook ad might spend $1,000 over their lifetime.

Meanwhile, those who found your product through organic means, such as SEO or content marketing, may spend over $9,000 given how much valuable information they perused before purchasing.

CLTV also helps you zero in on the demographic that purchases your products most. For example, if a specific demographic segment gets more CLTV, prioritizing customer acquisition for that segment will likely lead to higher revenue and average order value (AOV).

Tracking CLTV Improves the Entire Customer Journey

“Lifetime” is the relevant word. Understanding CLTV helps you improve the entire customer journey and provide value at every stage, from acquisition to post-purchase support.

Churn rates go down significantly when the customer journey is seamless and convenient. This ultimately allows businesses to create sustainable revenue streams rather than aggressively seeking new customers.

6 Best Practices for Improving Your CLTV

Increasing CLTV requires shifting your focus from acquisition to retention. Consider these five best practices to do just that.

Optimize Marketing/Acquisition Channels

The first step to ensuring high CLTV is optimizing your acquisition channels. Focus on the best-performing ones and monitor key performance indicators.

For CLTV, you’d want to track conversion rates and customer acquisition costs (CAC). Learning which channels yield the best results lets you iterate smartly for sustainable growth. After all, focusing on winning channels leads to better resource allocation, lower CAC, and more revenue.

Segment Customers and Personalize Marketing at Scale

Segmenting customers by demographic, intent data, or activity helps personalize marketing at scale. The more relevant the offer, the higher the chances customers stay in business for longer.

For example, segmenting via in-app activities is a powerful strategy if you're selling an SEO solution. Suppose 30% of users spend most of their time using your keyword research tool. You can segment those users and trigger in-app messages to upsell a higher-tier service with premium or better keyword research features.

Keep in mind that segmentation should always be integrated into every outreach strategy. To do this, build your ICPs and buyer personas, qualify leads, and leverage automated personalization tools.

Create a Tailored Approach to Onboarding

On-boarding should be catered to the individual needs of your customers. They all have different preferences, pain points, and goals, after all. It’s your job to provide the right resources to help them achieve their goals as conveniently and efficiently as possible.

Tailoring your onboarding process leaves a lasting impression, which increases the chances of customers wanting to learn more about your business and remaining committed for the long haul.

Improve Customer Support

Competition persists regardless of industry. One of the most significant reasons why customers jump ship to the competition is customer support.

If you can’t run a 24/7 customer support line, consider integrating automated chatbots that can direct users to what they need. Also, ensure that your support staff has all the tools and resources necessary to assist your customers, no matter their issues.

Offer Referral Programs

People trust their peers. That’s why word-of-mouth has one of the highest conversion rates among all forms of marketing. It denotes a high level of trust and authority that most expensive marketing campaigns can’t replicate.

If you have customers who are happy with your product/service, they’ll likely recommend you to people they know. With a referral program, they’d be more incentivized to do so. Customers now become brand ambassadors that can help build a community.

Prioritize Up-Selling and Cross-Selling

Up-selling and cross-selling can significantly improve CLTV by boosting a customer’s average order value (AOV). Remember, selling to previous customers is easier than getting new ones.

Let’s say you’re in ecommerce, selling smartphones. If a new phone model is released, you can send a promotional message to customers who bought the previous version. That’s up-selling.

Cross-selling, on the other hand, sells products related to previously bought ones. A that powers a phone will be significantly receptive when you recommend a power bank. Personalize your offering. It has to be relevant to your customer. To personalize, just look into a customer’s purchasing data, create a segmented list, and send your offer.

Key Takeaways

CLTV is an important metric that identifies the best customer acquisition and retention approach for higher overall revenue. To recap, you can calculate your as follows:

CLTV = CV X ACL, wherein CV = APV X APF.

To improve your CLTV, apply the following best practices:

- Optimize your marketing channels

- Segment customers and personalize outreach at scale

- Create a tailored approach to onboarding

- Provide the proper tools and resources to support staff

- Offer referral programs

- Prioritize up-selling and cross-selling

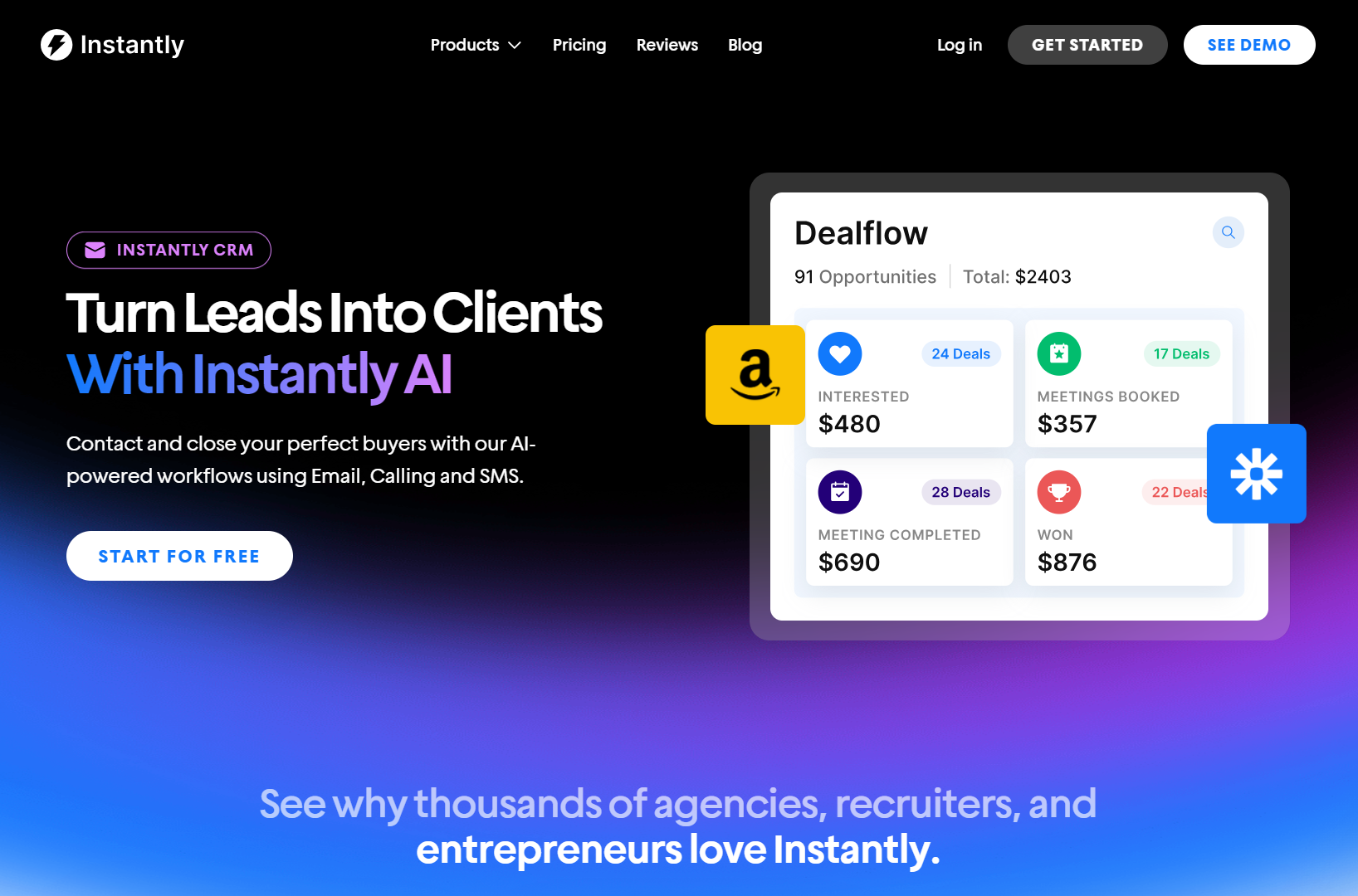

Want to give your CLTV a boost? Start by improving sales engagement and lead intelligence. Try Instantly Dealflow CRM today.