TL;DR

- Best overall for scaling on a budget: Instantly flat pricing with unlimited accounts and warmup (4.2M+ private network), SISR isolation on Light Speed, integrated 450M+ lead data, and Unibox for reply management.

- Best runner‑up with unlimited accounts: Smartlead unlimited mailboxes and warmup are included, but plans cap active leads which increases cost rapidly as lists grow.

- Best for creative heavy content campaigns: Lemlist per‑user plans and lemwarm Essential included on all paid tiers, array of creative formats supported.

- Best for multichannel workflow: Reply new AI SDR packaging prices by active contacts and advertises unlimited mailboxes and warm‑ups. Validate the limits during procurement.

If you want costs that don't explode as you add clients, pick a flat‑fee, unlimited‑account platform with automated warmup, ongoing inbox placement tests, and deliverability isolation. Instantly gives you unlimited accounts on every outreach plan, automated warmup (4.2M+ network) and placement tests, and SISR isolation with a DFY (done-for-you) email setup. Tools like Saleshandy, Lemlist, Apollo, Smartlead, and Reply are strong in parts, but seat‑based pricing, active‑prospect caps, and weaker deliverability protections can raise both cost and risk at scale.

Why agencies look beyond Saleshandy in 2025

1) Per‑seat and per‑volume models tax growth.

Seat‑based or prospect‑based pricing scales cost with headcount or list size. Apollo lists per‑user pricing. Saleshandy emphasizes active prospect and monthly send caps in its plans. Smartlead caps active leads per plan. These models become expensive as you add clients and inboxes.

2) Deliverability rules are stricter.

Gmail and Yahoo now require bulk senders to authenticate with SPF, DKIM, and DMARC. Outlook.com began routing non‑compliant high‑volume mail to Junk on May 5, 2025 and has stated rejections will come later. Agencies need warmup, authentication, and ongoing inbox placement testing built in.

3) Inbox placement still isn’t a given.

Across providers, the average deliverability rate is about 83.1%, which means 1 in 6 marketing emails never reaches the inbox. Continuous placement testing and list hygiene are non‑negotiable.

4) Tool sprawl drains margin.

Companies still juggle ~100+ SaaS apps on average and are consolidating to cut spend and risk. Outreach stacks that require extra tools for data, warmup, and reply ops add real TCO.

What to evaluate first (so you can scale without surprises)

1) Cost model: flat‑fee vs seats or active‑prospects

Flat‑fee with unlimited accounts keeps spend predictable as you add client inboxes. Instantly Outreach plans include unlimited accounts and warmup, Saleshandy uses active prospects and monthly send caps, Apollo is per‑user.

2) Deliverability assurance: warmup, isolation, and automated tests

Look for automated warmup, blacklist checks, and ongoing inbox placement tests. Instantly offers one‑time and automated placement runs. SISR on Light Speed assigns dedicated or private IP blocks and rotates them to reduce cross‑campaign bleed.

3) Scalability & operations: unlimited accounts and a unified inbox

Unlimited inboxes let you spread volume and protect sender reputation. Unibox centralizes replies with labels, macros, reminders, and a mobile app for handling at scale.

4) AI for personalization and reply handling

Sequence generation, copy variants, analytics summaries, and AI agents that triage and respond cut manual load. Instantly Copilot and AI Reply Agent cover this, with HITL (human in the loop) and Autopilot modes.

5) Ecosystem fit

Native CRM imports and webhooks reduce glue‑work. Instantly supports HubSpot, Salesforce, and Pipedrive imports, plus webhooks and Slack notifications.

Top Saleshandy alternatives for agencies (2025)

Instantly: the agency growth engine

Why agencies pick it

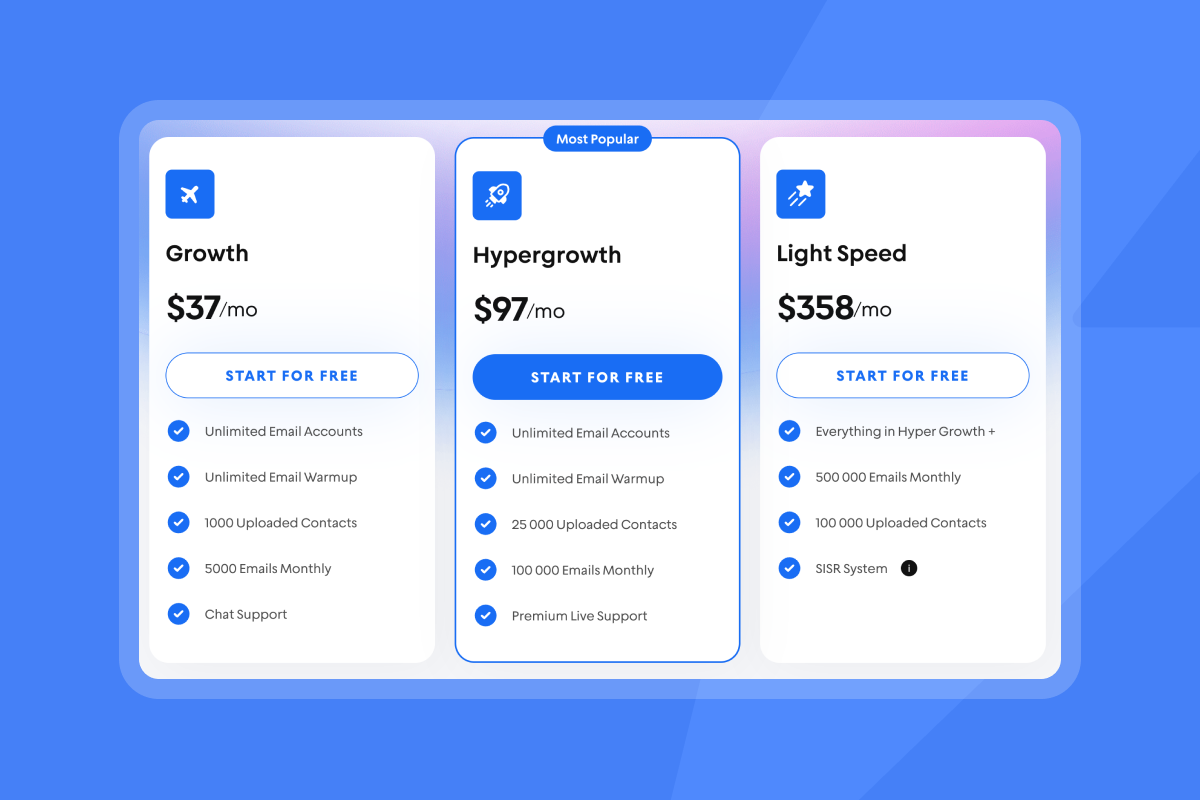

- Pricing and scale: Unlimited email accounts and warmup on all outreach plans keep cost flat as you add client inboxes. 4.2M+ private warmup network with SISR isolation.

- Deliverability toolkit: Automated Inbox Placement tests, blacklist checks, and optional pre‑warmed accounts help you ramp safely.

- AI + data: Copilot for research and campaigns, AI Reply Agent for triage and responses, and SuperSearch with 450M+ B2B leads integrated to outreach.

- Ops: Unibox centralizes replies with labels, macros, reminders, and CRM imports and webhooks streamline handoffs.

Best for

Agencies that need predictable costs, many inboxes, built‑in deliverability safeguards, and AI to reduce manual work.

Here's our full walkthrough on how to get started with Instantly:

Smartlead : unlimited accounts with active‑lead caps

Why agencies pick it

- Scale economics. Smartlead advertises unlimited mailboxes and unlimited warmup on paid plans, which helps spread volume across many client inboxes.

- Centralized replies. A Master Inbox shows replies from all connected senders in near real time so teams can triage faster.

- Automation surface. Public API plus webhook docs for reporting, routing, and CRM handoffs.

Where it can bite you

- TCO creep from lead caps. If you work large lists, upgrading for higher active‑lead ceilings can raise cost.

- Operational quirks. A few user threads mention occasional reply‑sync issues in Master Inbox. Treat as anecdotal and test with your domains.

Best for

- Agencies that value unlimited mailboxes and an all‑in reply view, and can live with active‑lead ceilings by plan.

Reply: multichannel with new AI SDR packaging

Why agencies pick it

- Multichannel in one place. Email, calls, SMS, and LinkedIn automation steps live in a single sequencer.

- AI SDR plans. Reply’s current packaging prices by active contacts and highlights unlimited users, unlimited mailboxes, and unlimited warmups on plan pages.

Where it can bite you

- Contact‑based pricing. Active‑contact gates can push upgrades as your lists grow, which changes cost dynamics versus flat‑fee tools.

- Add‑on math. Some channels surface per‑account add‑on pricing for LinkedIn or Calls & SMS, so check the fine print before you commit.

- Platform risk on LinkedIn. Any LinkedIn automation has policy risk. Reply provides automation and a Chrome extension workflow, but you should still pilot carefully on secondary accounts.

Best for

- Teams that need email + LinkedIn + calling in one flow and accept active‑contact economics in exchange for breadth.

Lemlist: creative personalization with lemwarm on paid plans

Why agencies pick it

- Personalization‑forward. Lemlist is known for visual and dynamic personalization with approachable UX. Warmup is integrated as lemwarm.

- Warmup included. Lemlist states that every paid seat includes lemwarm Essential. That simplifies setup for teams.

Where it can bite you

- Per‑user economics. Costs rise with headcount and the number of sending inboxes because capacity is tied to seats.

- Isolation posture. Public docs emphasize warmup and best practices rather than advanced IP isolation. If you require dedicated IP or server‑level controls, confirm architecture.

Best for

- Teams that value creative personalization and are comfortable with per‑user pricing and sending‑account caps per seat.

Apollo: sales‑intelligence‑first with built‑in sequencing

Why agencies pick it

- Data depth plus engagement. Apollo combines a large B2B database with sequences for email, calls, and LinkedIn tasks, plus a dialer and task manager.

- Per‑user pricing with credits. Pricing is per user with credit allowances and a Fair Use Policy that governs “Unlimited.” Budget around credits if you export or enrich heavily.

Where it can bite you

- Seat and credit costs. Per‑user licenses plus add‑on credits can make high‑volume sending expensive compared with flat‑fee senders.

- Warmup history. Third‑party posts documented periods when warmup functionality was unavailable. Treat recent warmup docs as current, but pilot and confirm deliverability support.

Best for

- Research‑heavy teams that want data + sequencing in one tool and are comfortable pairing it with a separate high‑volume sender if needed.

Instantly.ai vs Saleshandy: a direct comparison for agencies

| Category | Instantly.ai | Saleshandy |

|---|---|---|

| Pricing model | Flat-fee per workspace for Outreach. Unlimited email accounts on all outreach tiers. | Active-prospect and monthly send caps. |

| Unlimited email accounts | Yes on all outreach tiers. | Per-sequence sender rotation is capped by plan. |

| Warmup | Unlimited warmup on all outreach tiers. | Warmup via TrulyInbox partner, no warmup network listed |

| Deliverability isolation | SISR & dedicated 4.2M+ private warmup network with IP blocks & rotation. | Shared pools noted publicly. No SISR-style isolation. |

| AI features | Copilot for research and campaigns, AI Reply Agent for triage and responses | AI writing and rotation aids are mentioned fewer details on reply automation depth in public docs. |

| Lead database | SuperSearch 450M+ leads integrated to outreach. | Lead Finder credits available |

| Unified inbox/CRM | Unibox with labels, macros, reminders, and CRM imports. | Unified Inbox is available. |

| Best for | Agencies needing predictable, inbox-at-scale economics with built-in testing and AI-assisted ops. | Teams OK with active-prospect pricing and lighter deliverability protections. |

Bottom line: both tools can work for outbound, but the economics, data and deliverability differ widely. Instantly favors predictable scale via unlimited accounts, 450M+ contact datbase (no credit system) and bullet proof deliverability. Saleshandy ties plan value to active prospects, monthly send caps, and per‑sequence sender rotation limits, with warmup provided by partner TrulyInbox.

See unlimited email accounts cold outreach ROI for a breakdown of the math for agencies on MQL costs

Making the switch: a fast migration from Saleshandy

- Export the essentials. Export contacts, suppression lists, and templates. Clean the list as you go. Use Instantly's CSV bulk imports for a fast start or our developer API.

- Warm and align. Set SPF, DKIM, and DMARC for sending domains. Ramp gradually and run Instantly's automated inbox placement tests.

- Turn on deliverability telemetry & feedback loops. Enroll Gmail Postmaster Tools for domain/IP reputation & spam‑rate tracking, Microsoft SNDS/JMRP for Outlook/Hotmail complaint feeds, and Yahoo Complaint Feedback Loop. Watch spam rate, aim for <0.3% spam and <2% bounce rates and adjust sending/routing if it trends up.

- Enable one‑click unsubscribe. Add RFC 8058 headers,

List-Unsubscribe(HTTPS URL) andList-Unsubscribe-Post: List-Unsubscribe=One-Clickand keep a human‑visible unsubscribe link in the footer. Gmail/Yahoo expect true one‑click and timely processing Gmail also ties mitigation eligibility to this. - Onboard your team and start sending. generate sequences end to end with Instantly's AI Copilot to kick off your first campaign.

Check our cold email masterclass to get more qualified leads at a lower cost:

Choose scale, not complexity

Instantly delivers predictable scale with unlimited accounts, a 450M+ contact database, and strong deliverability, while Saleshandy prices by active prospects with monthly caps, limits per-sequence sender rotation, and relies on TrulyInbox for warmup. Start your free Instantly trial.

FAQs

Q1: What pricing model is simplest for agencies?

Flat‑fee per workspace with unlimited sending accounts avoids the seat or prospect tax. Instantly lists unlimited accounts and warmup on every outreach plan. Saleshandy ties limits to active prospects and monthly send caps. Apollo is per user. Always confirm current pricing on vendor pages.

Q2: Which deliverability controls matter most in 2025?

Automated warmup, DMARC alignment, recurring inbox placement tests, and infrastructure isolation to prevent cross‑campaign reputation issues. Gmail and Yahoo now require authentication for bulk senders. Outlook.com began junking non‑compliant high‑volume mail on May 5, 2025.

Q3: How much email never reaches the inbox?

Roughly 16.9% of marketing emails miss the inbox on average across providers, according to EmailToolTester’s 2024/2025 analyses.

Q4: Does Lemlist include warmup on entry tiers?

Yes. lemwarm Essential is included with all paid lemlist plans. Pricing is per user and may vary by billing cadence, so confirm at checkout.

Q5: Can I manage replies without logging into each mailbox?

Yes. Unibox centralizes replies from every connected account, supports labels and macros, and has a mobile app.