Updated October 28, 2025

TL;DR: Calculate outbound CAC (Customer Acquisition Cost) payback with this simple formula: CAC payback (months) = CAC ÷ (ARPU x gross margin). Aim for payback in 6 to 12 months and an LTV:CAC ratio near 3:1 to keep growth capital efficient. Improve payback by raising reply and meeting rates, protecting deliverability, and reducing cost per meeting. Instantly reduces CAC payback with unlimited accounts and warmup, a private deliverability network, Inbox Placement tests, SuperSearch lead data, and AI agents that draft and triage replies. Use the calculator template below to run your numbers.

For B2B sales leaders who own pipeline, this guide gives you the math, benchmarks, and plays to shorten payback.

Why quantifying your outbound efforts is critical for growth

If you cannot measure outbound CAC payback, you cannot plan headcount, budgets, or scale safely. Payback shows how long it takes to recover acquisition costs using gross profit, not just revenue.

Healthy SaaS teams often plan for CAC payback in the 6 to 12 month range, balancing speed with cash needs in a given market cycle. As outlined by Saras Analytics and the Growth Equity Interview Guide, operators use this range to manage capital efficiency. Many finance leaders also expect an LTV:CAC ratio near 3:1 to keep unit economics durable, especially for recurring revenue models.

When you quantify CAC payback by channel, you can scale what works, pause what harms sender reputation, and defend your plan to the CFO.

The cost of not knowing your numbers

- You overspend on per-seat tools while reply rates slip and deliverability degrades.

- You report vanity metrics like opens and ignore gross margin, which distorts ROI.

- You scale sends from a few inboxes and trip spam filters, which delays revenue and stretches payback.

Sustainable growth requires financial clarity

A repeatable outbound motion starts with clean inputs and consistent reporting. That means verified contacts, safe throughput, accurate CRM attribution, and dashboards that reconcile meetings and revenue by source. Instantly’s flat-fee, unlimited account model and audit-friendly reporting are built for this operating discipline.

Key metrics for outbound success: definitions and importance

- Customer Acquisition Cost (CAC). Total outbound costs in a period divided by new customers sourced from outbound in the same period.

- Customer Lifetime Value (LTV). Expected gross profit from a customer over their lifetime. Common approach: ARPU x gross margin x average lifetime in months.

- CAC payback period. Months to recover CAC using gross profit. A simple model for subscriptions is CAC ÷ (ARPU x gross margin).

- Return on Investment (ROI). (Outbound revenue attributed minus outbound costs) ÷ outbound costs.

- Pipeline conversion rate. Conversion between funnel steps such as reply to meeting, meeting to opportunity, and opportunity to closed won.

- Reply rate. Replies ÷ delivered emails. Cold email replies often sit near 1 to 5 percent depending on list quality, targeting, and inbox placement.

Watch our 1M email study on what works to increase your reply:

- Average Revenue Per User (ARPU). Average monthly or annual revenue per customer.

Why these matter:

- CAC and payback tell you when outbound turns profitable.

- LTV and LTV:CAC protect long term unit economics.

- Reply rate and pipeline conversion pinpoint where to fix messaging, data, or routing.

- ARPU and gross margin keep ROI grounded in profit, not top line bookings.

How to calculate your outbound ROI and performance: step-by-step formulas

Prerequisites

- Clean attribution: Tag sequences and sync replies, meetings, opportunities, and revenue to CRM. Deduplicate multi touch deals.

- Cost ledger: Include SDR and AE time, outreach software, lead data, verification, domains, and creative or agency spend. Both Mailmodo and Amplitude recommend accounting for people, tools, and data in CAC.

- Gross margin: Use gross profit, not revenue, for payback accuracy. Margin tightens the math to what you actually keep.

Step-by-step instructions

- Calculating outbound CAC

Formula: CAC = Total outbound costs in period ÷ New customers from outbound in period.

Include people cost allocation, tools, data, creative, and domain infrastructure. A practical CAC ledger often uses a 70 to 90 percent allocation of SDR time to outbound and a smaller AE time allocation for discovery and closing on outbound-sourced deals. - Determining outbound LTV

Pick one consistent approach and publish it on the dashboard.

- LTV = ARPU x gross margin x lifetime months.

Or - LTV = (ARPU x gross margin) ÷ monthly churn rate.

Use the same definition across teams so finance and sales data match.

- Measuring CAC payback period for outbound email

Formula: CAC payback (months) = CAC ÷ (ARPU x gross margin).

Benchmark targets: Many operators plan around 6 to 12 months, with faster payback favored when capital is tight or churn is higher. - Formula for outbound ROI

ROI = (Revenue attributed to outbound − total outbound costs) ÷ total outbound costs.

If payback is your main lens, run a profit-based ROI by substituting gross profit for revenue. - Tracking pipeline conversion rate

For each step, track volume and percent conversion:

- Delivered to reply

- Reply to qualified response

- Reply to meeting

- Meeting to opportunity

- Opportunity to closed won

Use your own baselines by segment. Public benchmarks vary by industry and ticket size, so trends matter more than one-size targets.

- Assessing reply rate and cost per meeting

- Reply rate = Replies ÷ delivered. Teams on verified lists with solid placement often see 1 to 5 percent.

- Cost per meeting = Total outbound cost ÷ meetings booked.

- Reply rate to revenue. Multiply replies by reply-to-meeting rate, then opportunity rate, close rate, and ARPU to estimate revenue per 1,000 sends. This is your reply rate to revenue calculator.

- Data inputs checklist for accurate calculations

- Sends and delivery: Delivered emails, bounces at or below 1 percent.

- Replies: Positive, neutral, negative, OOO. Track qualified replies.

- Meetings: Booked and held, with no-shows removed.

- Opportunities: SQLs with source = outbound.

- Closed won: Amount, term, and gross margin.

- Costs: People, software, data, creative, domains.

- Timing: Match cohort windows. Example: customers acquired in Q2, costs from Q2.

Checks and validation

- Reconcile campaign metrics to CRM. Volumes should match or be explained.

Watch how to use Instantly's CRM end to end in this tutorial:

- Exclude inbound and partner-sourced deals from outbound calculations.

- Use first touch or last touch consistently and label it in your reports.

- Validate meeting and opportunity counts against calendar and pipeline objects.

Common pitfalls

- Counting opens as a proxy for intent.

- Ignoring gross margin in payback math.

- Mixing inbound and outbound in the same CAC pool.

- Skipping list verification and inflating reply rates with bounces.

Success metrics

- CAC payback trending toward 6 to 12 months.

- LTV:CAC near or above 3:1.

- Reply rate at or above your baseline with bounces at or below 1 percent.

- Cost per meeting decreasing quarter over quarter.

Worked example: reply rate to revenue and payback

- Inputs: 10,000 delivered emails in a month. Reply rate 3 percent. Reply to meeting 30 percent. Meeting to opp 50 percent. Opp to win 25 percent. ARPU 300 dollars per month. Gross margin 80 percent. Outbound cost for the month 12,000 dollars. New customers from outbound 20.

- Pipeline math: 10,000 x 3 percent = 300 replies. 300 x 30 percent = 90 meetings. 90 x 50 percent = 45 opps. 45 x 25 percent = 11 wins.

- Revenue and profit: 11 wins x 300 dollars ARPU = 3,300 dollars monthly revenue. Gross profit per month = 3,300 x 80 percent = 2,640 dollars.

- CAC: 12,000 dollars ÷ 20 customers = 600 dollars.

- Payback: 600 ÷ 2,640 = 0.23 months. This is intentionally simple. If your average first month revenue is discounted or onboarding costs are material, use those adjustments in the calculator. The same math also shows how small lifts in reply or meeting rate compound into faster payback.

Watch how users are leveraging Instantly to increase their outbound CAC payback:

"In just the past 180 days, I've been able to book over 100 meetings, close deals worth more than €15,000..." - Dustin G. on Trustpilot.

Interactive outbound ROI calculator and template

- Cold email ROI and CAC payback calculator covering CAC, LTV, LTV:CAC, payback, pipeline conversion, and a reply rate to revenue calculator.

- Downloadable Google Sheet and CSV template with editable inputs.

Optimizing your outbound campaigns based on metrics

If payback is slow, fix inputs in this order: deliverability, data quality, message-market fit, process and routing, then safe scale.

Improve deliverability and sender reputation

Warm up and ramp safely: New or rested inboxes should start low and ramp slowly. As an operating rule, do not scale past 30 emails per single inbox per day. Use multiple warmed inboxes to grow throughput safely.

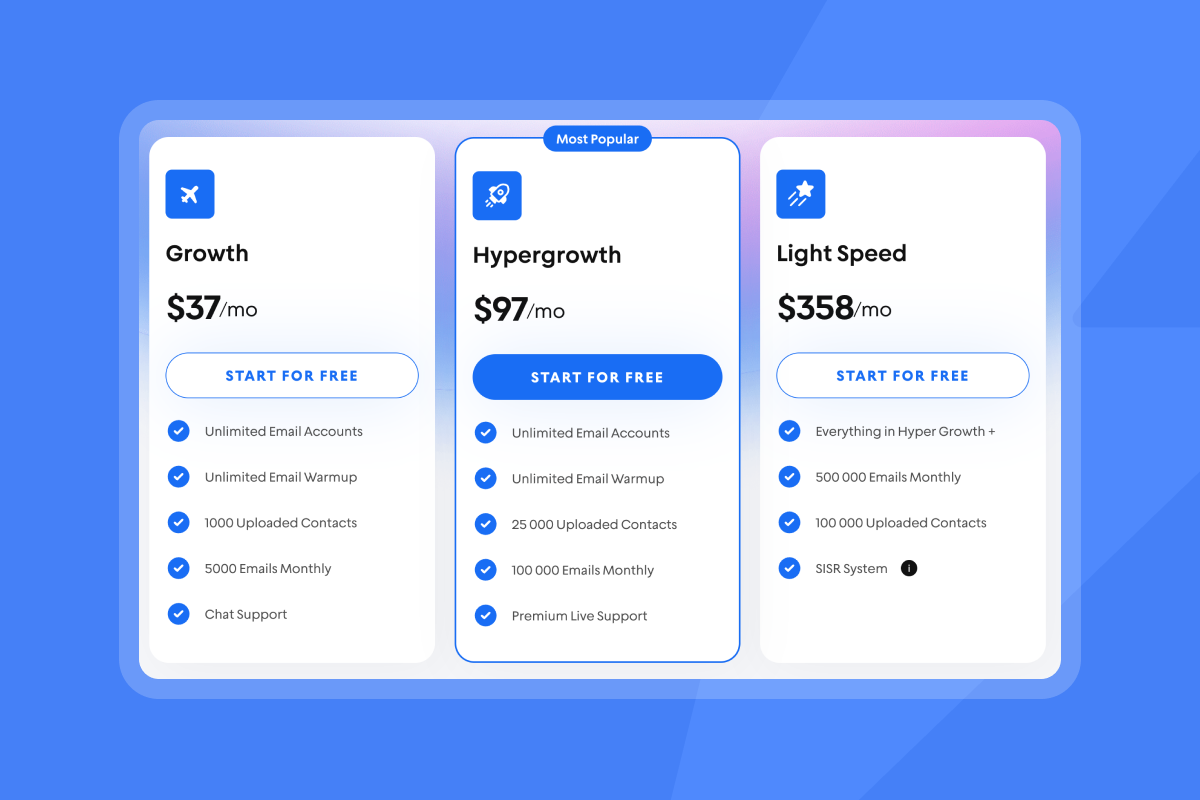

Use unlimited accounts: Unlimited email accounts and warmup on all outreach plans spread volume across many senders without per seat penalties.Run Inbox Placement tests: Validate primary inbox placement before scaling and set alerts to pause if placement dips. For automation steps, see the detailed guide in our help center.

Protect domain health: Verify SPF, DKIM, and DMARC. Use custom tracking domains. Keep complaint rates low and unsubscribes easy.

Use SISR when you scale: Light Speed adds Server and IP Sharding and Rotation on dedicated or private pools via VIP setup to support higher volumes while protecting placement.

Watch bounce rate: Keep hard bounces at or below 1 percent by using verified contacts and ongoing list hygiene. List cleaning and verification lift ROI and protect reputation.

Instantly operates a private deliverability network and reports 4.2M+ accounts supporting warmup and engagement.

Takeaway: Better placement raises opens and replies without raising send volume, which speeds payback without extra spend.

Watch how to setup warmup on Instantly in just a few clicks:

"Deliverability tools that actually move the needle... land in Primary instead of Promotions/Spam." - Anthony V. on G2.

"Unlimited Email inbox warmup is included with all the plans... This saves a ton of time." - Chinmay K. on G2.

Checklist: deliverability and health

- DNS alignment verified for all domains.

- Inbox Placement at or above 80 percent across key providers before scaling.

- Bounce rate at or below 1 percent. Pause and re-verify if higher.

- Complaint rate low. Simple unsubscribe and relevant targeting.

Enhance lead quality and targeting

- Verified contacts only: Do not send to unverified emails. Clean lists reduce bounces and protect sender reputation.

- Use SuperSearch: Tap 450M+ B2B leads with enrichment and filters that match your ICP, then export to campaigns or CRM SuperSearch. For enrichment context, see the overview of signals and filters in the lead enrichment guide.

- Segment by signals: Firmographics, technographics, hiring, funding, and installed tools make value props precise.

- QA leads weekly: Pull samples to spot pattern drift, duplicates, and consent issues.

Refine messaging and A/B testing

- Test with discipline: Run A/Z tests on subjects and first lines. Hold everything else constant, and use sufficient sample sizes for a clean read Optimize outreach A/B testing.

- Use spintax sparingly: Vary phrasing to reduce repeats without changing meaning.

- Tune send windows: Send when buyers read email. Review placement and reply curves by hour of day and adjust windows by region Mastering email send windows.

- AI assisted drafts: Use Copilot to generate variants and research micro segments, then edit for clarity and accuracy Copilot.

Streamline sales processes and reporting

- Unify replies: Use Unibox so no reply slips through, and triage faster to meeting.

- Automate reply handling: AI Reply Agent can answer in under 5 minutes and route to Slack for review or run in autopilot.

- Reconcile to CRM: Use native integrations or a connector to map replies, meetings, opportunities, and revenue back to the right campaign.

- Audit-friendly reporting: Keep one standard dashboard that matches CRM counts and labels your attribution model.

Scale efficiently for agencies and startups

- Flat-fee economics: Avoid per seat models that bloat CAC as you add inboxes. Unlimited accounts let you distribute throughput safely.

- Throughput without risk: Spread volume across many warmed inboxes while keeping per inbox caps low.

- Multi client management: Standardize playbooks, lists, and dashboards across workspaces.

- Cost per meeting clarity: Track spend and meetings by client or segment to catch rising CAC early.

- Cash efficient ramp: Start with a low cost stack. Add credits only when reply to meeting lift is proven.

Success metrics to track after changes

- Payback shortens by 1 to 3 months within two sales cycles.

- Reply rate rises by 20 to 50 percent on verified lists.

- Cost per meeting decreases 15 to 30 percent with AI triage plus better placement.

- Bounce rate stays at or below 1 percent during scale.

Your next step

- Use the calculator template and run your current numbers.

- Start a free Instantly trial for a predictable, integrated stack that includes unlimited accounts and warmup, a private deliverability network, Inbox Placement tests, SuperSearch access to 450M+ B2B contacts, Copilot for drafting, AI Reply Agent for triage, and transparent reporting that reconciles with your CRM.

- For a full platform tutorial, watch the Instantly walkthrough on YouTube.

FAQ

What is a good CAC payback period for outbound email?

Many SaaS teams plan for 6 to 12 months, with faster favored in cash tight environments.

How does deliverability impact CAC payback?

Poor inbox placement lowers replies and meetings, which delays revenue. Raise placement with warmup, placement tests, verified contacts, and safe per inbox caps.

Can I calculate LTV from outbound campaigns?

Yes. Use the same LTV model across channels. Examples include ARPU x gross margin x lifetime months, or gross profit per month ÷ churn rate.

How do I standardize outbound reporting across my sales team?

Define a single attribution model, sync replies and meetings to your CRM, use standardized dashboards, and log all costs. Instantly’s Unibox, AI Reply Agent, and CRM integrations help keep reporting audit-friendly through its Integrations Library.

What role does AI play in optimizing outbound ROI?

AI drafts copy, enriches leads, and handles replies within minutes. Instantly’s AI Reply Agent responds in under 5 minutes and runs in human in the loop or autopilot modes to improve speed to meeting and lower cost per meeting.

Key terminology glossary

- CAC: Total outbound costs divided by new customers from outbound.

- CAC payback: Months to recover CAC using gross profit per month.

- LTV: Expected total gross profit from a customer.

- LTV:CAC: Ratio comparing value created to cost to acquire.

- ARPU: Average revenue per user per month.

- Reply rate: Replies divided by delivered emails.

- Pipeline conversion: Conversion rates for reply to meeting, meeting to opportunity, opportunity to win.

- Gross margin: Revenue minus cost of goods sold, expressed as a percent of revenue.